jersey city property tax calculator

Select Advanced and enter your age to alter age. Several factors - like your marital status salary and additional tax withholdings - play a role in how much is taken out.

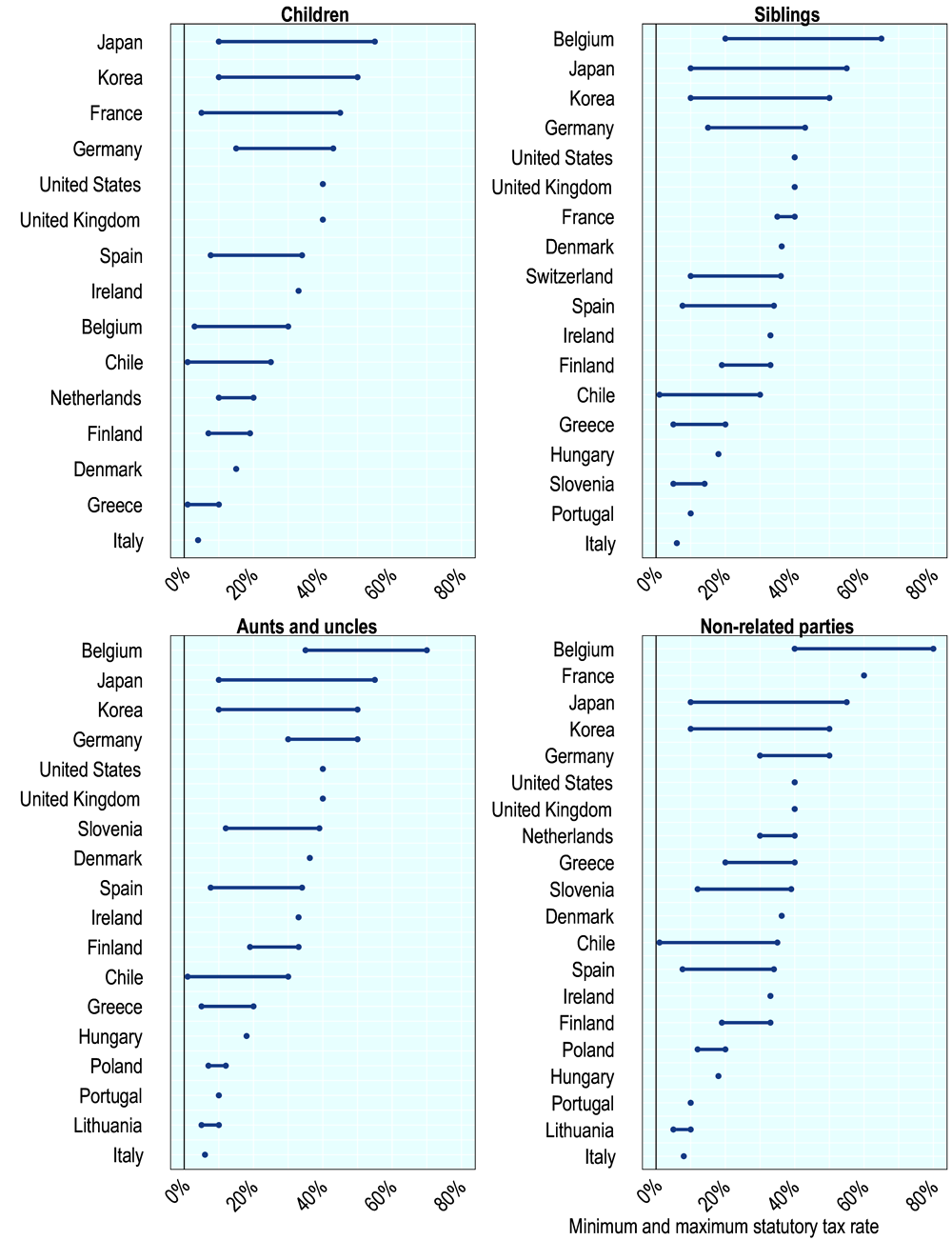

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

. The calculator makes standard assumptions to estimate your tax and long-term care. Follow these simple steps to calculate your salary after tax in Jersey using the Jersey Salary Calculator 2022 which is updated with the 202223 tax tables. Taxes in New Jersey.

Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. The money collected is generally used to support community safety schools infrastructure and other public projects. An individual taxpayers property taxes are calculated by multiplying the.

A towns general tax rate is calculated by dividing the total amount needed to be raised by the total assessed value of all its taxable property. TO VIEW PROPERTY TAX ASSESSMENTS. In Person - The Tax Collectors office is open 830 am.

If you live in Jersey and need help upgrading call the States of Jersey web team on 440099. Box 2025 Jersey City NJ 07303. Property Tax Calculator - Estimate Any Homes Property Tax.

The Garden State has a lot of things going for it but low taxes are not among its virtues. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Below 100 means cheaper than the.

King Drive 3rd floor Jersey City NJ 07305 email protected Edward Toloza CTA City Tax Assesor. For comparison the median home value in New Jersey is 34830000. The tax rates for the listed municipalities are the rates applicable in 2016 and will be.

The results you see are based on this years allowances 2022. How Your New Jersey Paycheck Works. Look Up an Address in Your County Today.

To view Jersey City Tax Rates and Ratios read more here. Enter Your Salary and the Jersey Salary Calculator will automatically produce a salary after tax illustration for you simple. 1050 cents per gallon of regular gasoline 1350 cents per gallon of diesel.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. Property taxes in America are collected by local governments and are usually based on the value of a property. 242 average effective rate.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. The total amount of property tax to be collected by a town is determined by its county municipal and school budget costs. Tax amount varies by county.

It doesnt send any information to Revenue Jersey or make changes to your records with us. Office of the City Assessor City Hall Annex 364 ML. The median property tax on a 11820000 house is 124110 in the United States.

Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period. Jersey City establishes tax levies all within the states statutory rules. Ad Request Full and Updated Property Records.

280 Grove St Rm 101. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Purchase Price Purchase Price is the only field required.

New Jersey State Tax Quick Facts. Real estate evaluations are undertaken by the county. The median property tax on a 29410000 house is 308805 in the United.

City of Jersey City. Revenue Jersey PO Box 56 St Helier Jersey JE4 8PF. Get Results On Find Info.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys. Search Nj Property Tax Estimator. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Overview of Property Taxes. HOW TO PAY PROPERTY TAXES. City of Jersey City Tax Collector.

Online Inquiry Payment. The tax rate for The Oakman is calculated based on current variable factors that may change over time which may cause the rate to vary from the amounts listed. This calculator will help you understand the basics of how tax works.

City of Jersey City. Ad Just Enter your Zip for Property Values By Address in Your Area. 201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey.

By Mail - Check or money order payable to. For comparison the median home value in New Jersey is. The average effective property tax rate in New Jersey is 242 compared to.

Ad Search Nj Property Tax Estimator. The median property tax on a 11820000 house is 204486 in Illinois. Free Comprehensive Details on Homes Property Near You.

Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements. The median property tax on a 11820000 house is 171390 in Jersey County. Federal income taxes are also withheld from each of your paychecks.

Online Inquiry Payment. Use this calculator to estimate your NJ property tax bill. Expert Results for Free.

Revenue Jersey Taxes Office postal address. Get Reliable Tax Records for Any Local County Property. Total Tax Savings Years 18-20.

189 of home value.

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Buying A House In New Jersey Bankrate

Property Taxes How Much Are They In Different States Across The Us

Jersey City Quietly Imposed A New Fee On Residents Then The Backlash Got Too Loud Nj Com

Who Pays What In The Los Angeles County Transfer Tax

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Alaska Property Tax Calculator Smartasset

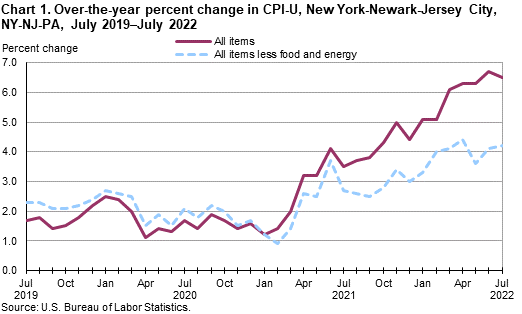

Consumer Price Index New York Newark Jersey City July 2022 New York New Jersey Information Office U S Bureau Of Labor Statistics

Property Tax Calculator Casaplorer

/182667184-56a636213df78cf7728bd987.jpg)

How Is Cost Basis Calculated On An Inherited Asset

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

2022 Capital Gains Tax Rates By State Smartasset

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Property Tax Calculator Casaplorer

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Who Pays What In The Los Angeles County Transfer Tax